If you are already enrolled in LTC and have questions or want to make changes to your coverage, please contact Chubb Customer Service at (855) 241-9891.

NVIDIA offers voluntary life insurance with long-term care (LTC) benefits from Chubb insurance. Please note this benefit will not replace your existing life insurance - you can be enrolled in both plans. The Chubb plan helps protect you with a long-term care event. Please review the information below.

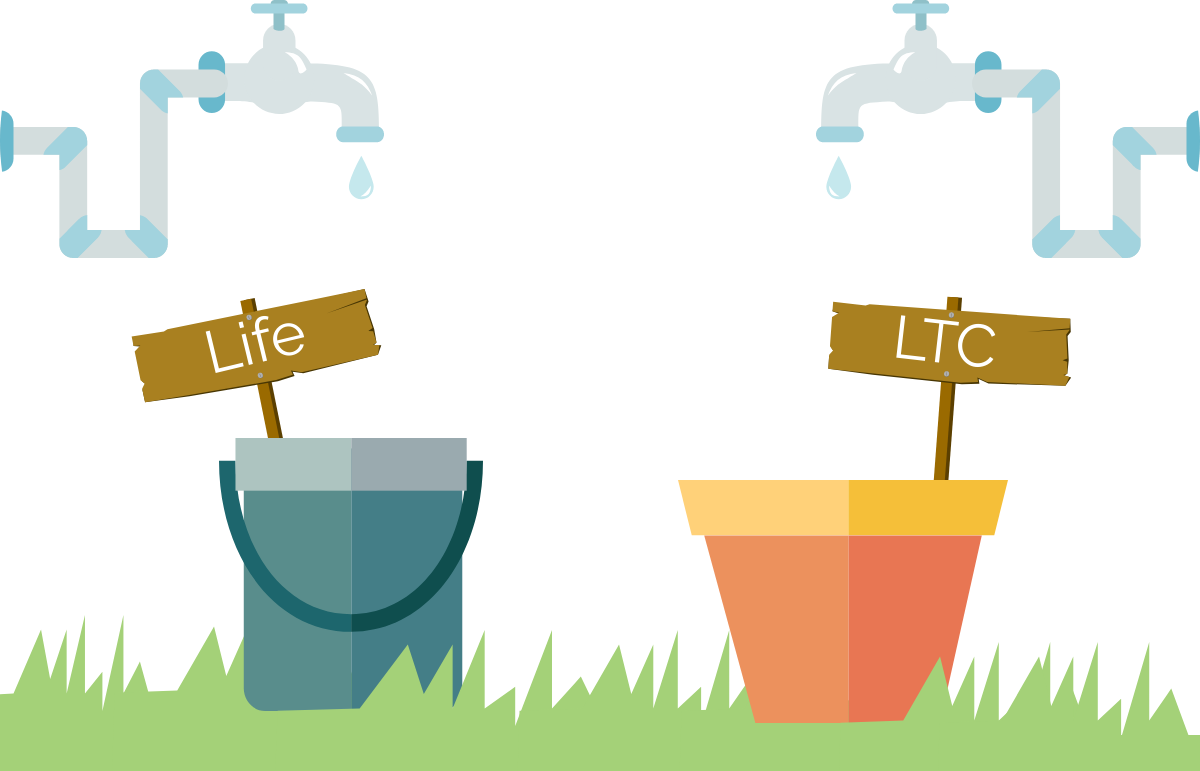

One policy with two benefits. Life insurance protection for your family during your work years and long-term care protection if you happen to need care at any point through age 120. As long as coverage is active, a benefit will always pay.

Eligible new employees can enroll with guaranteed acceptance (no health questions). Select up to $150,000 of life insurance with automatic acceptance (no health questions). Eligible spouses/partners can select up to $75,000 of life insurance with limited health questions. All other employees and their spouse/partner may apply anytime with evidence of insurability.

Pricing is based on your age. The longer you wait to purchase coverage, the more expensive it will be. Also, the life insurance premiums are guaranteed NOT to increase.

Life insurance protects your family with money that can be used any way they choose. It is most often used to pay for mortgage or rent, education for children and grandchildren, retirement, family debt, and final expenses. You can select up to $150,000 with simplified acceptance into the program. .

If you become chronically ill, your policy will pay you 4% of your selected life insurance amount each month you receive Long Term Care. You will have access to 3x your life insurance amount to help pay for LTC services.

Example: $100,000 of life insurance would pay $4,000 per month in LTC benefits with a total LTC benefit of $300,000.

Long-term care services can be expensive. According to the US Department of Health and Human Services, the average cost of care can range from $48,048 - $100,380 per year depending on the type of care you are receiving and where you are receiving that care. Long-term care planning should be a included in any responsible personal financial plan.

Financial stress is never a good thing, especially if you're thinking about retirement. If you are concerned about being able to afford healthcare costs in retirement or outliving your retirement savings you're not alone according to a recent MetLife study. The largest potential healthcare expense during retirement may be a long-term care event. The Chubb life insurance with LTC benefits program offers long-term care protection if you happen to need care at any point.

More than half of Americans say they need long-term care coverage yet only around 1/3 have coverage. As we age the likelihood of needing long-term care services increase. The most recent US Department of Health & Human Services data says around 70% of us will need care at some point. That's a big number! The good news is the Trustmark program offers you both life insurance, to protect your family now, and long-term care coverage if you happen to need those services later on.

Chubb’s core companies are rated AA for financial strength by Standard & Poor’s and A++ by A.M. Best.

These are the top ratings.